Kai Kaufhold and Bernd Heistermann presented the actuarial survival analysis as an alternative to classical portfolio analyses of life, pension and health insurance business at a meeting of the German Actuarial Society in Wiesbaden on 8 March 2017.

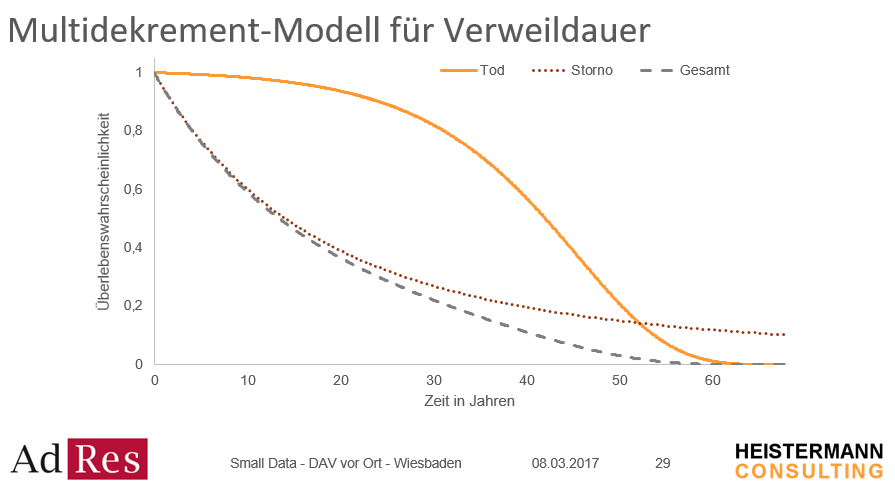

Actuarial survival analysis enables the joint modelling of different factors influencing mortality, lapse and disabilty rates.

For this purpose, parametric “hazard rate” functions are used, which in the case of mortality correspond to the so-called “force of mortality”. This also makes it possible to make statements in small and medium-size portfolios that are not covered by the classical methods of analysing incidence probabilities, because they can only be used per risk group and therefore require an analysis of ever smaller and smaller sub-portfolios. By means of parametric survival analysis, the information lying dormant in the portfolios is optimally used, because the models are continuous in time and age, and thus all individual risks can be modelled to the day. In addition, the statistical key figures directly accessible during survival analysis offer a good opportunity to quantify the estimation accuracy. The two speakers explained several practical applications for this methodology in insurance companies. The spectrum ranged from the reservation and derivation of best estimates for Solvency II to product development, sales management and reinsurance optimisation. The presentation (in German language only) can be downloaded here. Both speakers will be happy to answer any questions you may have and on request give a detailed presentation of the methodology.